-

Canadian Consumer Credit Market Continued to Expand, with Evident Signs of Payment Stress

Source: Nasdaq GlobeNewswire / 28 May 2024 06:00:00 America/New_York

Key findings from TransUnion report:

- Credit participation in Canada continued to rise, led by new-to-country and Generation Z consumers, driving total debt to $2.38 trillion

- Continued higher cost of living and interest rate pressures led to rising consumer-level delinquencies

- Alberta experienced the highest rate of delinquencies (2.21%), Quebec saw the lowest rate (1.29%), and Ontario displayed the most significant increase (+26 basis points, year-over-year)

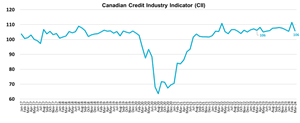

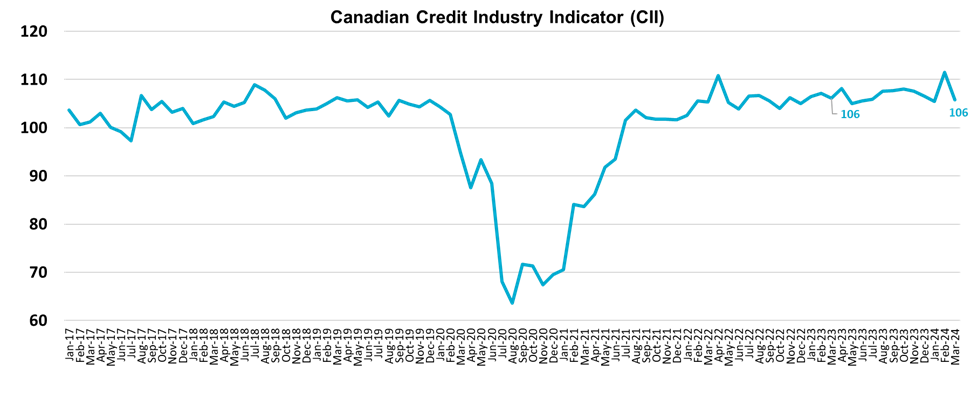

TORONTO, May 28, 2024 (GLOBE NEWSWIRE) -- Amid persistent economic challenges marked by high inflation and interest rates, Canada's credit market continued to expand during the first quarter of 2024. The TransUnion Credit Industry Indicator (CII) remained stable year-over-year (YoY) at 106. The CII demonstrated the aggregated effect of higher consumer credit demand being met with restrained lender risk appetite, consumers leveraging credit and slight negative pressure from rising delinquency rates.

The CII is part of the quarterly TransUnion Credit Industry Insights Report, and maps consumer credit market health.

During this quarter, credit participation – measured as the number of credit-active consumers –grew 3.75% YoY, with a historic record of 31.8 million Canadians now holding one or more credit product(s). New-to-Canada consumers remain a strong driver of this growth trend, with originations within this group increasing by 33% YoY, representing 11% of new origination volumes.

Additionally, younger Canadians, specifically Generation Z (born 1995 - 2004) consumers, are driving the surge in credit participation, while exhibiting a 30% YoY growth in outstanding balances. Balance growth in this cohort was primarily driven by card and personal loan products, which increased by 18% and 11% respectively during Q1 2024.

Concurrently, credit participation among Millennials (born 1980 – 1994) grew 5% YoY. This generation is now the largest share of consumers by age participating in Canada’s credit market, holding 27% of credit accounts – surpassing the share of Baby Boomers (born 1946 - 1964) for the first time. Millennials hold the largest share of debt ($911 billion of the $2.38 trillion credit market) – approximately 38% of all debt, likely due to higher credit needs in their lifecycle as they grow older.

“Inflationary pressures may lead consumers to turn to bankcards or personal loans to help make ends meet, and Millennials and Gen Z consumers are no exception,” said Matthew Fabian, director of financial services research and consulting at TransUnion Canada. “Lenders need to carefully monitor credit performance in the coming year, particularly among younger consumers and those at lower income levels who may be more vulnerable to the current economic strains of elevated inflation and interest rates. A portion of consumers in these segments are likely to still see some challenges despite anticipated interest rate relief later in the year.”

Continued macro pressures have led to performance deterioration

The impact of the current higher cost of living varies across Canada’s provinces in turn influences payment capacities and delinquency rates. Furthermore, specific regional economies can be more susceptible to economic shifts in unemployment and productivity, which further places strain on consumers.

For example, Alberta led all provinces in Q1 2024 with a 2.21% serious consumer-level delinquency (more than 90 days past due), followed by New Brunswick (2.16%) and Manitoba (2.11%). Even though the serious consumer-level delinquency rate in Ontario is relatively lower at 1.82%, it saw the highest YoY increase in serious consumer delinquencies – 26 basis points (bps), followed by Manitoba and Quebec (24 bps).

Table 1: Total Consumer-Level 90 Days Past Due by Province

Q1 2023 Q1 2024 YoY change (bps) Canada 1.57% 1.76% +20 AB 2.08% 2.21% +13 NB 2.11% 2.16% +5 MB 1.87% 2.16% +24 NS 2.02% 2.06% +3 SK 1.89% 2.00% +11 NL 1.91% 2.00% +9 PEI 1.71% 1.86% +15 ON 1.56% 1.82% +26 BC 1.60% 1.69% +8 QC 1.06% 1.29% +24

“Despite these rising delinquency levels, Canada’s commodity-producing provinces remain best positioned to weather growth headwinds,” said Fabian. “These regions generally experience more volatile economic conditions, given their additional dependency on commodity prices and seasonality. Cost of living increases are not uniform and impact regions differently across Canada. While we see delinquency rates rise faster in some areas, future economic growth and lower interest rates are expected to offset this in the long run.”When viewed nationally, consumer-level serious delinquency rates on non-mortgage balances increased by 19 bps YoY, to 1.75%. When looking at individual credit products, consumer-level delinquencies increased YoY for all products with the exception of personal loans.

Table 2: Consumer-level serious delinquencies across products – Q1 2024

Product Consumer-level 90+ DPD YoY Change (bps) Credit Card 0.91% +14 Auto Finance 0.57% +4 Personal Loans 1.33% -2 Lines of Credit 0.28% +9 Mortgage 0.15% +4

In addition to rising delinquencies, more accounts are rolling forward into later stages of delinquency – 11% more did so than in the same quarter in 2023. Moreover, the volume of charge-offs (where debt is deemed unlikely to be collected by the creditor) increased approximately 2% as consumers faced increasing pressure to make their due payments.Payment stress evident in consumer behaviours

Historically high interest rates have led to higher payment obligations across non-mortgage credit products. During times of economic uncertainty and stress, consumers generally tend to prioritize mortgage payments over other products, as demonstrated by TransUnion’s payment hierarchy study. Given the higher payments that many consumers now face on their mortgages, some consumers are making lower payments on other non-mortgage obligations, including credit cards, where consumers can pay less than their full outstanding balance each month. In recent periods, the amount consumers pay over the minimum required payment due on credit cards has decreased, driving up revolving balances. As a result, the aggregate excess payment (AEP)1 to outstanding balance ratio has declined by 187 bps YoY.

The percentage of cardholders making only the minimum payment due has grown by 1.3% (up 8 bps YoY). As fewer consumers are paying down their card balances, revolving balances are growing.

“We have observed that when consumers are faced with mortgage payment shock, the impact on credit card delinquency is two to three times that of mortgage delinquency,” Fabian said. “Non-mortgage debt held by homeowners is now well above 2019 levels, with at least 50% of outstanding mortgages yet to be repriced.”

Given that specific pockets of consumers are experiencing elevated interest rate and inflation sensitivity, lenders have access to tools that can predict early signs of vulnerability.

“Lenders are best positioned to fuel smart growth by identifying resilient consumers at origination and by predicting and helping consumers who are likely to miss a payment,” Fabian said. “Proactively monitoring risk levels and identifying early warning signals of default can help lenders identify vulnerable consumers before they exceed limits or miss payments, and in turn help fund sustainable growth within the resilient consumer segments.”

1 TransUnion developed a metric called the Aggregate Excess Payment to better gauge how much in excess of the minimum payment was made. The variable was calculated by subtracting the total minimum due from the total payments made across all of a consumer’s credit cards.

About TransUnion® (NYSE: TRU)

TransUnion is a global information and insights company with over 13,000 associates operating in more than 30 countries, including Canada, where we’re the credit bureau of choice for the financial services ecosystem and most of Canada’s largest banks. We make trust possible by ensuring each person is reliably represented in the marketplace. We do this by providing an actionable view of consumers, stewarded with care.

Through our acquisitions and technology investments we have developed innovative solutions that extend beyond our strong foundation in core credit into areas such as marketing, fraud, risk and advanced analytics. As a result, consumers and businesses can transact with confidence and achieve great things. We call this Information for Good® — and it leads to economic opportunity, great experiences and personal empowerment for millions of people around the world.

For more information visit: www.transunion.ca

For more information or to request an interview, contact:

Contact: Katie Duffy

E-mail: katie.duffy@ketchum.com

Telephone: 647-772-0969A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f99b3d45-e0d9-4d3c-89c1-c44ad6744497